salt tax cap married filing jointly

When it comes to married people filing jointly on taxes the maximum income limit is 250000. For married taxpayers filing separately the cap is 5000.

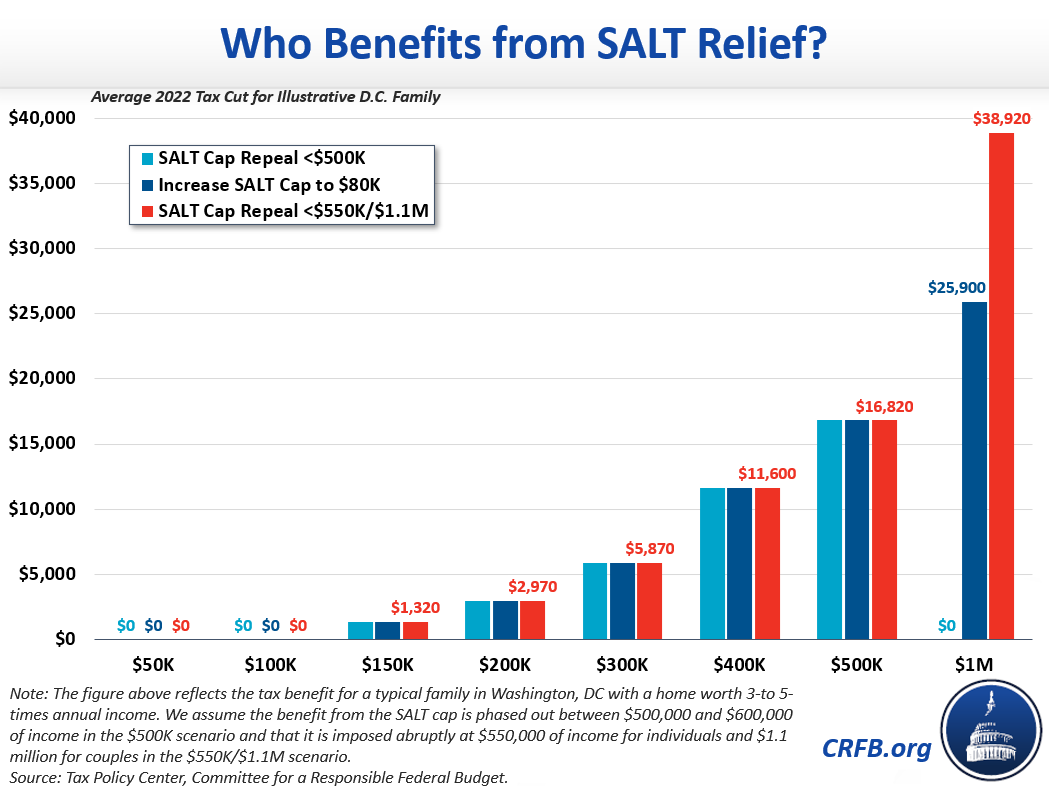

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and.

. The increase to the standard deduction under TCJA resulted in more taxpayers claiming the standard deduction rather than itemizing. The arrival of the TCJA meant that the standard deduction amount was increased which reduced the number of taxpayers eligible to have deductions and capped the overall SALT deduction at 10000. Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed.

As part of the plan there are income caps for those who qualify to take advantage of these benefits. In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

The Tax Cuts and Jobs Act TCJA enacted in December 2017 limited the itemized deduction for state and local taxes to 5000 for a married person filing a separate return and 10000 for all other tax filers. It is 10000 for all other filing statuses. By limiting the SALT deduction available to certain taxpayers the SALT cap decreases the tax savings associated with the deduction relative to prior law thereby increasing federal revenues.

It has not passed yet. The arrival of the TCJA meant that the standard deduction amount was increased which reduced the number of taxpayers eligible to have deductions and capped the overall SALT deduction at 10000 per return for single filers head of household filers and married taxpayers filing jointly19112021. Do we combine our state and local income taxes and real estate taxes together and figure out.

And there was no limit on how much you could deduct. Hello Its my first time filing a joint return for 2019 year. Ad Compare Your 2022 Tax Bracket vs.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. How Does The Deduction For State And.

0 Reply SweetieJean Level 15. Your 2021 Tax Bracket To See Whats Been Adjusted. The SALT deduction includes property income and sales taxes.

The limit is 5000 if. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. It is 5000 for married taxpayers filing separately.

Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. Beginning with 2018 the TCJA has capped the maximum SALT deduction at 10000. For example if you are a person with a Single filing status taking the largest possible amount for your SALT deduction at 10000 the total amount of the rest of your itemized deductions would need to be more than 2550 to exceed your standard deduction amount of 12550 so that you can itemize and deduct SALT.

What is the salt cap for married filing jointly. If you are filing Married Filing Joint your total itemized. The limit is 5000 if married filing.

Under tcja the salt deduction was capped at 10000 for single filers and married couples filing jointly. New tax law for 2018. 0 Reply TaxGuyBill Level 9 June 6 2019 620 AM As a side note it is still a PROPOSED tax law for 2018.

Is it 5000 for Married Filing Separately. Married couples filing jointly. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

The measure dubbed the Restoring Tax Fairness for States and Localities Act or HR 5377 proposes increasing the so-called SALT cap to 20000 for married taxpayers who are filing jointly in 2019. Discover Helpful Information And Resources On Taxes From AARP. Trying to figure out how much of our 2018 state refund went over the 10k SALT cap.

However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. By limiting the SALT deduction available to certain taxpayers the SALT cap decreases the tax savings associated with the deduction relative to prior law thereby increasing federal revenues. Anyone who itemized could deduct property taxes in their entirety.

As a side note it is a 10000 limit for the combined total of SALT and Real Estate taxes. My partner and I each received 1099gs in a high tax state. The proposal also addresses an unfair marriage penalty where two single filers could each claim a 10000 SALT deduction but once they marry and file jointly theyre still limited to 10000 or.

For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont itemize if write-offs including SALT medical expenses. However they had a choice between deducting their income taxes and sales taxes. However Becourtney said the 10000 SALT deduction limit is only applicable to taxpayers with a single married joint or head of household filing status.

State And Local Tax Salt Deduction Salt Deduction Taxedu

House Votes To Temporarily Repeal Trump Salt Deduction Cap The Hill

Legislation Introduced In U S House To Restore The Salt Deduction

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Supreme Court Definitively Ends The Salt Tax Deduction Case

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Revenue Neutral Salt Cap Relief Is Costly And Regressive Committee For A Responsible Federal Budget

North Carolina Providing Broad Based Tax Relief Grant Thornton

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

State And Local Taxes What Is The Salt Deduction

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

California Proposes State And Local Tax Cap Workaround

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Does The Deduction For State And Local Taxes Work Tax Policy Center