georgia property tax exemption for certain charities measure

The Georgia Property Tax Exemptions Referendum also. The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan.

94 Of Firms Plan To Maintain Or Heighten Charitable Giving

As anyone who has run a charity can tell you the IRS designation of a 501c3 non-profit doesnt necessarily apply to all of the non-IRS taxes that are out there including property taxes.

. When nonprofit organizations engage in selling tangible personal property at retail they are required to comply. The measure would exempt from taxes property owned by charities for the purpose of building or repairing single-family homes to be financed by the charity and sold to individuals. The Georgia Code grants several exemptions from property tax.

The measure which was approved by a vote of 73 to 27 exempted from property taxes property owned by a 501c3 public charity such as Habitat for Humanity if the property is. New signed into law May 2018. Referencing data from the tax calculator most homeowners in.

What types of real property have. The Georgia Charitable Institutions Tax Exemptions Referendum also known as Referendum C was on the November 7 2006 ballot in Georgia as a legislatively referred state statute where it. All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located.

Pay Property Taxes Property taxes are paid annually in the county where the property is located. 2 An exemption equal to the assessed value of the property to a any person who has the legal or equitable title to real estate with a just value less than two hundred and fifty thousand dollars as determined in the first tax year that the owner applies and is eligible for the exemption and who has 74 maintained thereon the permanent residence of the owner for not less than twenty-five. Property Tax Exemption for Certain Charities Measure.

These organizations are required to pay the tax on all purchases of tangible personal property. If a member of the armed forces dies on duty their spouse can be granted a property tax exemption of 60000 as long as they dont remarry. Property Tax Homestead Exemptions.

Shall the act be approved which provides an exemption from ad valorem taxes for all real property owned by a purely public charity if such charity is exempt from taxation under. Under Section 2 of Article VII of the state constitution property tax exemption bills require a two-thirds supermajority vote rather than a si See more. The state legislature referred one measure concerning a property tax exemption for property owned by charities for the purpose of building or repairing single-family homes.

After passage of the Georgia Constitution of 1945 the legislature amended the exemption statute to allow the exemption to charities even if they used their property to raise income so long as. HB 498 - Proposition 2. Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax exemptions for agricultural equipment.

In general Georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations. Surviving Spouse of Peace Officer or. Property Tax Exemption for Certain Charities Measure.

Property tax exemption measures in Georgia The measure required a two-thirds vote in the Georgia State Legislature since it was designed to create a property tax exemption. Property Tax Returns and Payment. 1 2023 all timber.

Property tax exemption measures in Georgia The measure required a two-thirds vote in the Georgia State Legislature since it was designed to create a property tax exemption. September 19 2022. While the state sets a minimal property tax rate each county and municipality sets its own rate.

County Property Tax Facts.

Six Common Nonprofit Irs Audit Triggers Carr Riggs Ingram Cpas And Advisors

2020 Election What Amendments On The Georgia Ballot 11alive Com

Dentons Charities And Nonprofit Taxation

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Indirect Tax Kpmg United States

Doing Business In The United States Federal Tax Issues Pwc

Patient Financial Assistance Programs A Path To Affordability Or A Barrier To Accessible Cancer Care Journal Of Clinical Oncology

2020 2021 State Executive Orders Covid 19 Resources For State Leaders

About The Vehicles For Veterans Nonprofit Organization

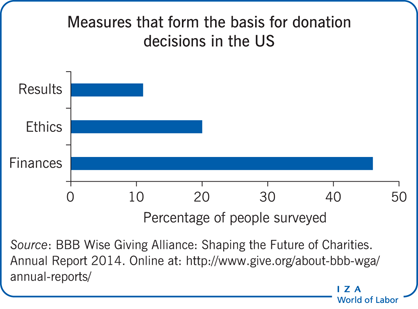

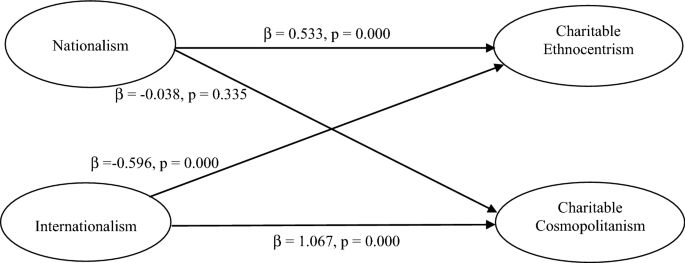

Does Charity Begin At Home National Identity And Donating To Domestic Versus International Charities Springerlink

Charity Auctions The Complete Guide Post Covid 19

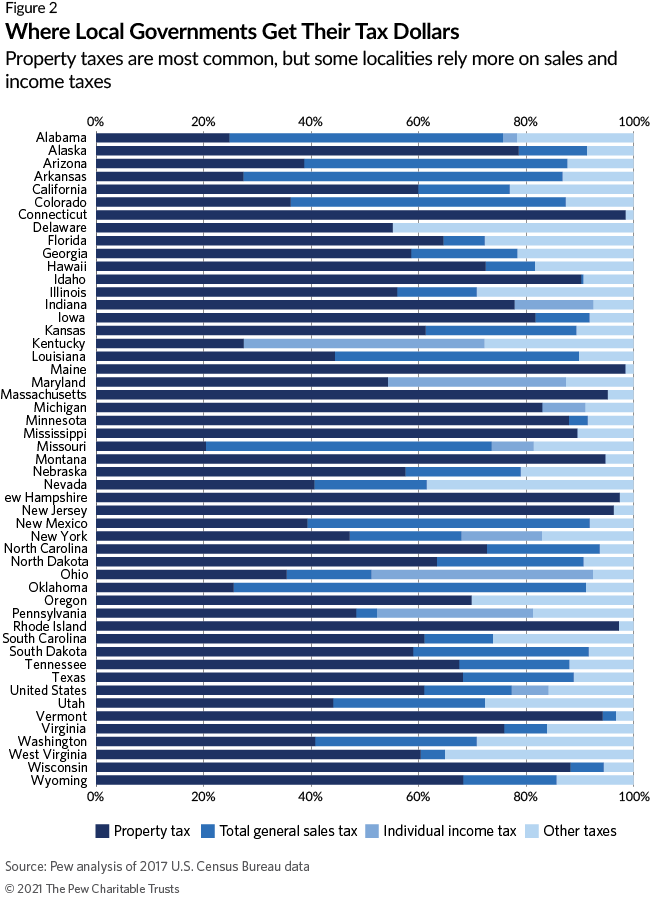

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

Whiplash Free And Fair Elections Act Won T Be On The Ballot After Last Minute Math Changes

Be Ready For Big Changes 2021 Tax Planning

Proposition 19 Which Modifies Prop 13 Property Tax Breaks Maintaining Its Lead In California

How Is Tax Liability Calculated Common Tax Questions Answered

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal